Looking to supercharge your SaaS sales team?

Effective commission structures are your secret weapon!

Start with a revenue-based model, typically 5-20%, to align incentives with financial goals. Want to push your top performers? Try tiered commissions with increasing rates as they hit higher targets.

Don’t forget about up-front and overtime options – they can work wonders for cash flow and long-term customer relationships.

Remember, the magic lies in balancing short-term gains with long-term success. Tailor your structure to your business objectives, use data analytics to fine-tune, and always keep it simple yet scalable.

Ready to dive deeper into the world of SaaS commissions?

Key Takeaways

- Revenue-based commissions align sales incentives with financial goals, typically ranging from 5-20% of deal value.

- Tiered commission structures reward performance through increased rates as sales reps hit higher achievement levels.

- Balancing upfront and overtime commissions motivates large deals while encouraging long-term customer relationships.

- Effective structures consider deal size, role differentiation, quota attainment, and align with overall business objectives.

- Data analytics enable continuous optimization of commission structures, improving forecasting and adaptability to market changes.

Revenue-Based Commission

Most SaaS companies use revenue-based commission structures to align sales incentives with their financial goals. It’s a smart move, really. Why?

Because it directly ties your paycheck to the money you bring in. Talk about motivation!

Here’s how it works: You’ll typically earn a percentage of the deal’s value, usually between 5% and 20%.

The average hovers around 10%. Not too shabby, right?

Since SaaS is all about that sweet, sweet recurring revenue, you might even earn commissions on renewals and expansions. Ka-ching!

Now, there are two main flavors of revenue-based commission in the SaaS world.

First, you’ve got the upfront commission. Close a $10,000 annual subscription at a 10% rate? Boom! $1,000 in your pocket right away. Or, you could go for the overtime commission. Same deal, but you’d get $83.33 each month. Slow and steady wins the race, eh?

Why do companies love this setup? It’s simple: happy salespeople, happy company.

You’re motivated to chase big deals and keep customers around. It’s a win-win situation that’ll have you seeing dollar signs in no time!

Tiered Commissions

Revenue-based commissions are great, but what if you could supercharge your earnings?

Enter the tiered commission structure, the secret weapon of savvy SaaS companies. It’s like a video game where you level up, but instead of virtual points, you’re raking in real cash!

Here’s how it works: Your company sets performance tiers based on metrics like annual recurring revenue or total contract value.

As you climb these tiers, your commission rate increases. For example, you might start at 5% for Tier 1, then jump to 7% for Tier 2, and so on.

The best part? Once you hit a higher tier, that juicy commission rate often applies to all your sales, not just the ones above the threshold. Talk about motivation!

But wait, there’s more! Some plans include accelerators for overachievement. Crush your quota, and you could be looking at even higher rates.

It’s like finding a secret level in that video game – except this time, you’re the one getting the high score in your bank account. Just remember, tiers usually reset periodically, so don’t rest on your laurels. Keep hustling, and watch those customer acquisition costs turn into fat commission checks!

Up-front commissions

Imagine getting paid your entire commission the moment you close a deal.

That’s the beauty of upfront commissions in SaaS sales. You don’t have to wait for the customer to pay over time – you get your reward instantly. Pretty sweet, right?

Here’s how it works: When you land a contract, you receive your full commission based on the total contract value.

Got a three-year deal worth $300,000? With a 10% commission structure, you’re looking at a cool $30,000 in your pocket right away. Talk about motivation to go after those big fish!

But hold your horses – it’s not all rainbows and unicorns. Companies might struggle with cash flow, especially startups. And watch out for those sneaky clawback provisions. If your customer bails early, you might have to cough up some of that commission. Ouch!

Some companies mix it up based on how customers pay. Full upfront payment? Full commission for you. Annual payments? You get paid yearly. It’s like a commission buffet – pick your flavor!

Overtime commission

While upfront commissions offer instant gratification, overtime commission structures in SaaS sales take a different approach.

Instead of a one-time payout, you’ll receive recurring payments based on the recurring revenue generated from your sale. It’s like getting a slice of the pie every month, rather than devouring the whole thing at once.

Here’s how it works: Let’s say you sell a $10,000 annual subscription with a 10% commission rate and a 12-month payment plan. You’d pocket $83.33 per month ($10,000 / 12 months x 10% commission rate).

Not too shabby, right?

This sales commission structure aligns your interests with the company’s goal of maintaining long-term customer relationships. It’s a win-win situation!

Overtime commission encourages customer retention and account growth. The longer your clients stick around, the more you earn. It’s like having a money tree that keeps on giving! But remember, this isn’t about working extra hours.

It’s about getting paid over time for your hard work. So, are you ready to embrace the long game and reap the rewards of recurring revenue?

Key Components of a SaaS Commission Structure

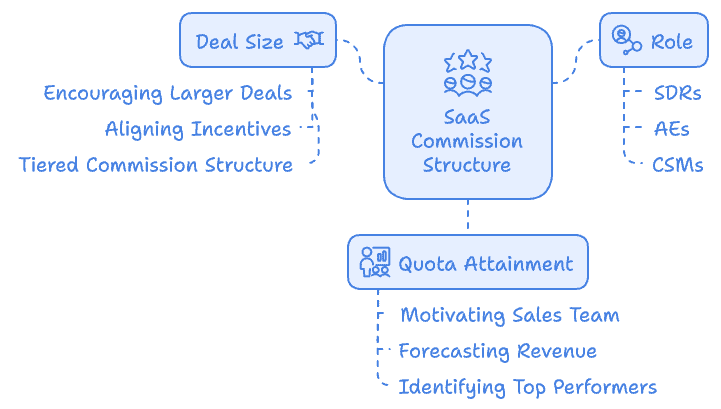

When crafting your SaaS sales commission structure, you’ll need to examine three key components.

First, think about the deal size – are you selling small subscriptions or enterprise-level packages?

Next, factor in the roles of your sales team members, as different positions may warrant different commission rates.

Finally, don’t forget to tie commissions to quota attainment, rewarding those who consistently hit their targets.

Deal size

Incorporating deal size into your SaaS commission structure is essential for aligning sales incentives with company goals.

When you base commissions on deal size, you’re encouraging your sales team to pursue larger, more strategic contracts that can greatly boost your annual contract value. It’s like telling your reps, “Go big or go home!” But don’t worry, it’s not just about size – it’s about value too.

Think of deal size as a reflection of the customer’s lifetime value. Larger deals often mean more stable recurring revenue and higher CLV. By implementing a tiered commission structure based on deal size, you’re motivating your team to push for those juicy enterprise contracts.

And let’s face it, who doesn’t love a good challenge?

But here’s the kicker: deal size isn’t just about making more money. It’s about balancing short-term wins with long-term value. By rewarding larger deals, you’re encouraging your team to think strategically and focus on contracts that’ll keep your revenue model humming along nicely.

So go ahead, size up those deals – your bottom line will thank you!

Role

Plunge into the heart of any successful SaaS commission structure, and you’ll find that role differentiation is crucial.

Your sales team isn’t a one-size-fits-all group, so why should their compensation plans be?

Each role plays a unique part in the customer journey, and your commission structure should reflect that.

Let’s break it down. Your SDRs are prospecting machines, so their quota might focus on qualified leads.

AEs are your closers, so tie their commissions to actual revenue. And don’t forget your CSMs – they’re the unsung heroes keeping customers happy and upselling like champs.

Their compensation plan could hinge on retention rates or expansion revenue. See the pattern?

Quota attainment

The cornerstone of any effective SaaS commission structure is quota attainment.

It’s the secret sauce that keeps your sales team hungry and your company’s revenue soaring.

Why?

Because it aligns individual performance with company goals. Your sales reps aren’t just chasing random numbers; they’re driving towards targets that matter.

Let’s talk commission plan basics. You set sales quotas, and your reps earn a commission percentage based on how well they hit those targets.

Smart companies use tiered commission rate ranges to really light a fire under their team. Hit 100% of your quota? Nice work! Now watch that commission rate jump as you crush it even further.

But quota attainment isn’t just about motivating your team (though it does that brilliantly). It’s also your crystal ball for forecasting revenue, identifying top performers, and spotting areas for improvement.

Are your reps consistently falling short? Maybe it’s time to revisit your product-market fit or beef up your sales training. Remember, in the SaaS world, customer success is king. So make sure your quotas reflect that long-term thinking.

Designing an Effective Sales Commission Model for SAAS

An effective SaaS sales commission model is crucial for driving growth and aligning your team’s efforts with company goals.

When designing your SaaS sales compensation plan, start by aligning it with your business objectives.

Consider your company’s growth stage, focus on acquisition or retention, and revenue goals. Then, structure the compensation mix, balancing base salary with variable pay.

Choose commission structures that fit your business model, such as flat rate, tiered, or revenue-based.

Set clear performance metrics like new customer acquisition, ARR, or customer retention rates. Don’t forget to account for customer lifetime value and promote collaboration among team members.

Here are three reasons why a well-designed commission model matters:

- It drives motivation and performance

- It attracts and retains top talent

- It aligns individual efforts with company goals

Determining the Right Commission Rate

Determining the right commission rate for your SaaS sales team can make or break your company’s growth trajectory.

So, how do you create a comp plan that’ll make your reps jump for joy without sending your profits into a nosedive?

Let’s immerse ourselves!

Start with the magic number: 10%. That’s your benchmark for a standard SaaS sales compensation plan.

But don’t just slap that on and call it a day! Consider your business objectives, sales process complexity, and profit margins.

Are you trying to acquire new customers or keep the ones you’ve got? Is your sales cycle longer than a giraffe’s neck? These factors will help you fine-tune your rates.

Now, let’s talk numbers. Aim for a 5x Quota: OTE ratio.

What’s that, you ask? It means your rep’s annual quota should be about five times their On-Target Earnings.

For example, if their OTE is $120,000, their quota should be around $600,000. Genius, right?

And don’t forget to balance base salary and commission. A 50/50 split is a good starting point for most saas companies.

Remember, your sales compensation plan should be as flexible as a yoga instructor. Calculate, adjust, and repeat!

Commission Rates for SaaS: Industry Standards

In the world of SaaS sales, 10% stands out as the golden standard for commission rates.

But don’t let that fool you – it’s not a one-size-fits-all solution. Your commission structure that rewards top performers might range from 5% to a whopping 30%, depending on various factors.

Think company size, product complexity, and market conditions.

When setting your saas sales commissions, consider these emotional drivers:

- The thrill of closing big enterprise deals with higher rates (8-15%)

- The satisfaction of steady income from a 50/50 base salary and commission split

- The excitement of accelerators that boost your earnings for overachievement

Remember, revenue commission isn’t just about the numbers. It’s about motivating your team to crush their quotas.

A smart commission rate for SaaS balances industry standards with your unique business goals. Commissions based on the total deal value? Sure, but don’t forget about renewals and upsells. They’re the lifeblood of SaaS success!

Want to create a commission structure that works? Start with 10%, then tweak it based on your company’s needs. You’ll find the sweet spot that keeps your sales team hungry and your bottom line healthy.

The role of data analytics in determining effective SaaS sales commission structures

Data analytics is the secret weapon for crafting killer SaaS sales commission structures. It’s like having a crystal ball that reveals what really drives your sales team.

Want to know which commission rates pack the biggest punch? Data’s got your back.

It’ll show you how to align your commission structure with your business goals, so you’re not just throwing money at the wall and hoping it sticks.

But wait, there’s more! Data analytics isn’t just about boosting sales performance. It’s your ticket to crystal-clear forecasting and transparency.

No more guessing games when it comes to commission payouts. Your sales reps will love you for giving them real-time visibility into their earnings. And let’s face it, happy reps mean more deals closed.

Data analytics helps you stay agile. Markets change, goals shift, and your commission structure needs to keep up. With data on your side, you can spot trends, test new ideas, and adapt faster than a chameleon in a rainbow factory. So, are you ready to harness the power of data and create a commission structure that actually works?

Legal considerations and compliance issues in SaaS sales commission structures

Legal landmines lurk beneath the surface of every SaaS sales commission structure.

You’ve got to navigate this minefield carefully to avoid costly mistakes.

First up, let’s talk contract terms and documentation. Get everything in writing, folks! Clear, detailed commission agreements are your best defense against disputes. Don’t skimp on the fine print.

Labor law compliance is another biggie. Are you meeting minimum wage requirements? Classifying employees correctly? One misstep here could land you in hot water faster than you can say “lawsuit.”

And don’t forget about revenue recognition under ASC 606. It’s a real headache, but you’ve got to get it right.

Here are three reasons to take these legal considerations seriously:

- Avoid crippling fines and penalties

- Protect your company’s reputation

- Sleep better at night (seriously, who doesn’t want that?)

Data protection and privacy laws are no joke either. Make sure you’re handling sensitive info with kid gloves. And remember, non-discrimination is key. Keep your commission structure fair and transparent to dodge those pesky bias claims. It’s a lot to juggle, but hey, no one said running a SaaS company was easy!

Case studies on successful SaaS sales commission structures

Let’s turn our attention to real-world examples of SaaS companies that have nailed their sales commission structures.

Ever wondered how the big players keep their salespeople motivated? Well, buckle up!

Salesforce, the SaaS giant, uses a tiered commission model that’ll make your head spin. They’ve got base salaries, increasing commission rates, and accelerators that’ll have your salespeople drooling. Talk about aligning incentives!

HubSpot keeps it simple with a flat 10% commission rate and no cap. Imagine the potential there!

Zendesk throws in some spice with multipliers for strategic products and accelerators for multi-year deals. Clever, right?

Challenges and Solutions in SaaS Sales Commission Structures

Designing an effective sales commission structure for SaaS companies is no walk in the park. You’re juggling complex revenue models, long sales cycles, and the need to incentivize both new sales and customer retention

It’s enough to make your head spin!

But don’t worry, we’ve got your back.

- Balancing short-term gains with long-term customer success

- Maneuvering the complexities of subscription-based software revenue

- Keeping your commission plan simple yet scalable as your team grows

First, align your commission structure with your business objectives. Reward reps for customer success, not just closing deals.

Use metrics like Annual Recurring Revenue (ARR) and Customer Lifetime Value (CLV) to calculate commissions.

And don’t forget to segment roles! Your account executives and account managers shouldn’t have identical commission plans.

Conclusion

You’ve got the tools to craft a killer SaaS sales commission structure.

Remember, there’s no one-size-fits-all solution. Experiment with different models, keep your team motivated, and always stay data-driven.

Don’t forget to keep it fair and compliant! Regular reviews and adjustments are key. With the right approach, you’ll boost sales, retain top talent, and drive your company’s growth. Now go out there and make those commissions work for you!